Buying a house is one of the most significant investments that a person can make in their lifetime. However, sometimes things don't go as planned, and buyers may pull out of a deal. It can be frustrating for both the seller and the buyer, but understanding the reasons why house buyers pull out can help prevent it from happening.

In this insight, we are going to explore the reasons buyers pull out alongside the financial implications it brings.

There are many reasons why buyers pull out of a property purchase. It helps to know what the reasons could be, specifically related to your property. It can allow you to make adjustments in price to compensate or set time aside to complete missing administrative tasks.

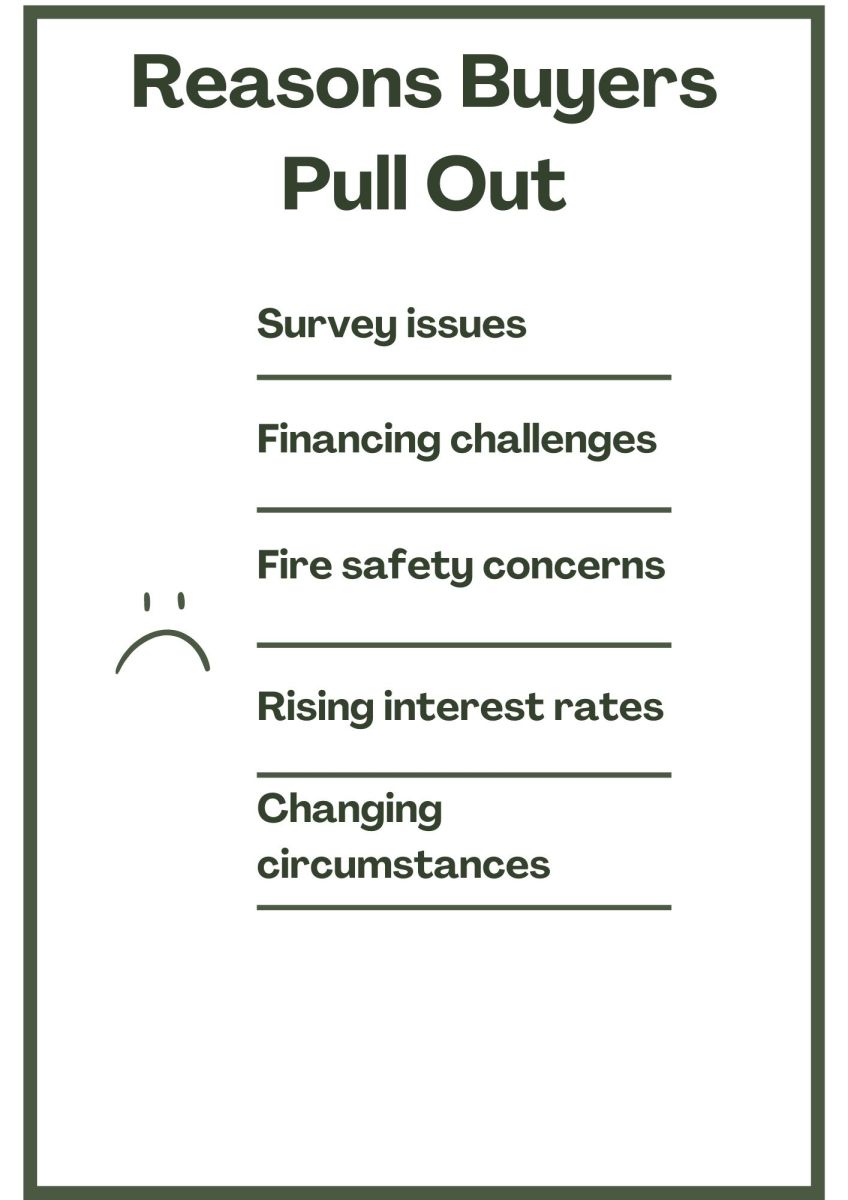

Some of the common reasons buyers pull out include:

Buyers often conduct property surveys to identify any underlying problems with the property. If the survey reveals significant issues such as structural defects, dampness, or electrical problems, buyers may become hesitant to proceed with the purchase. As a seller, it's important to be prepared for potential survey findings and consider addressing any major issues before putting the property on the market. Alternatively, sellers can adjust the price to reflect the necessary repairs or negotiate with the buyer to find a mutually agreeable solution.

Buyers heavily rely on securing financing to complete a property purchase. If buyers encounter challenges in obtaining a mortgage, such as changes in lending criteria, stricter affordability assessments, or personal financial issues, they may be unable to proceed with the transaction. Sellers can help mitigate this risk by ensuring that their property is in good financial standing, providing accurate and comprehensive documentation to potential buyers, and being open to discussions about alternative financing options.

Fire safety regulations have gained significant attention in recent years, particularly in the wake of high-profile incidents. Buyers are increasingly cautious about fire safety measures in properties, such as the presence of fire doors, functioning smoke detectors, and compliant electrical installations. If a property is found to have fire safety issues or fails to meet current regulations, buyers may reconsider their decision to purchase. Sellers should ensure their property is up to code and consider obtaining relevant certifications to provide assurance to potential buyers.

For more information, read our insight: Fire Safety Ratings and Mortgages

Interest rates play a significant role in mortgage affordability for buyers. If interest rates increase significantly, it can impact buyers' monthly mortgage payments and overall affordability. In such cases, buyers may reassess their financial situation and decide to pull out of the purchase if they feel the increased rates strain their budget. While sellers have no control over interest rate fluctuations, it's important to be mindful of market trends and be prepared for potential impacts on buyer decisions.

Life is unpredictable, and buyers' circumstances can change unexpectedly. Events like job relocations, changes in financial stability, or personal situations can influence buyers' ability or willingness to proceed with a property purchase. While sellers cannot control these circumstances, maintaining open communication and flexibility can help navigate such situations. Sellers may consider negotiating a delayed completion or being understanding if a buyer needs to withdraw due to genuine personal reasons.

Understanding these reasons helps sellers address concerns promptly, increasing the chances of a successful transaction. Being responsive, adaptable, and transparent creates a positive buying experience and reduces the risk of buyer withdrawal.

**** 4.2

Buyers may pull out last minute for a variety of reasons. While it may seem abrupt, it's often a result of circumstances that have developed throughout the home buying process. However, it's important to note that when buyers pull out too far into the process, it can have financial consequences for the seller.

Reasons for last-minute withdrawals include financing challenges, such as a loan application rejection due to a change in employment status, and unforeseen personal circumstances like a mandatory job relocation. Additionally, inspection concerns such as discovering extensive water damage during the inspection or appraisal discrepancies where the appraised value falls significantly short of the purchase price can lead buyers to reconsider and opt out. It's important for sellers to be aware of these possibilities and their potential impact on the transaction.

Dealing with a buyer pulling out of a home purchase can be challenging, but there are steps you can take to navigate the situation:

It's important to remain composed and approach the situation with a calm mindset. Try to ask the buyer to discuss their reasons for pulling out and understand their perspective.

Carefully review the purchase agreement and consult your solicitor to understand your rights and obligations. They can provide guidance on any legal recourse or options available to you.

Consider the current market conditions and the impact of the buyer's withdrawal on your selling timeline. If appropriate, relist the property and continue marketing efforts to attract new potential buyers.

If the buyer's withdrawal was prompted by property-related concerns, such as inspection findings, evaluate the issues and consider addressing them. Making necessary repairs or adjustments to address any identified problems can increase the appeal of the property to future buyers.

Rely on the expertise and support of your agent throughout the process. They can provide guidance, market insights, and help navigate any challenges that arise.

Remember, every situation is unique, and it's essential to consult with professionals, such as real estate agents and attorneys, to determine the best course of action based on your specific circumstances.

In the UK, if a buyer pulls out of a property transaction, it is generally difficult to claim damages. However, there are a couple of situations where the seller may seek compensation, and these are only possible after 'exchange of contracts':

If the buyer has paid a deposit, typically 10% of the property's purchase price, and withdraws without a valid reason, the seller may be allowed to keep the deposit as compensation for the breach of contract.

In rare cases, if the buyer's withdrawal is considered a breach of contract and the seller can prove significant financial losses or hardship as a result, they may ask the court to order the buyer to fulfill their obligations and proceed with the purchase.

Remember, pursuing legal action can be complex and costly. It's advisable to consult a solicitor specialising in property law to assess your specific situation and explore available options. In many cases, finding a new buyer may be a more practical approach.

You will still need to pay solicitor fees if your buyer pulls out. You will need to speak directly with your solicitor to find out how they can proceed. It could be that they are able to roll your fees to your next property transaction. Depending on how much work has already been completed, you may or may not be out of pocket. Unfortunately, you cannot claim damages for this.

**** 4.2

If you have had a buyer pull out and are unsure where to start with reviewing your circumstances. If you are looking for advice on moving home or buying a property for the first time, we can put you in touch with the best-suited mortgage adviser for your needs. Complete the Sunny Fact Find to get started. Once completed, the best adviser for your needs contacts you to explain how they can help. You decide how to proceed.

There are many reasons why house buyers pull out, and some of them may be out of the seller's control. However, by understanding the common reasons why buyers pull out, sellers can take steps to mitigate these issues and increase the chances of a successful sale. Keeping the lines of communication open and addressing any concerns as soon as possible can help build trust and prevent any surprises down the line.

Stuart is an expert in Property, Money, Banking & Finance, having worked in retail and investment banking for 10+ years before founding Sunny Avenue. Stuart has spent his career studying finance. He holds qualifications in financial studies, mortgage advice & practice, banking operations, dealing & financial markets, derivatives, securities & investments.

No minimum

No minimum  Newcastle-under-Lyme, Staffordshire

Newcastle-under-Lyme, Staffordshire Free Consultations

Free Consultations

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Coatbridge, Lanarkshire

Coatbridge, Lanarkshire Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

No minimum

No minimum  Initial or Ongoing Consultation Fees

Initial or Ongoing Consultation Fees

£21,000 +

£21,000 +  Initial fee free consultation

Initial fee free consultation

London, Greater London

London, Greater London No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  No obligation consultation

No obligation consultation

£101,000+

£101,000+  Bishop's Stortford, Hertfordshire

Bishop's Stortford, Hertfordshire No obligation consultation

No obligation consultation

No minimum

No minimum  Stockton-on-Tees, County Durham

Stockton-on-Tees, County Durham Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Cheltenham, Gloucestershire

Cheltenham, Gloucestershire No obligation consultation

No obligation consultation

No minimum

No minimum  Free Consultations

Free Consultations

No minimum

No minimum  Initial fee free consultation

Initial fee free consultation

No minimum

No minimum  Free Consultations

Free Consultations

Our website offers information about financial products such as investing, savings, equity release, mortgages, and insurance. None of the information on Sunny Avenue constitutes personal advice. Sunny Avenue does not offer any of these services directly and we only act as a directory service to connect you to the experts. If you require further information to proceed you will need to request advice, for example from the financial advisers listed. If you decide to invest, read the important investment notes provided first, decide how to proceed on your own basis, and remember that investments can go up and down in value, so you could get back less than you put in.

Think carefully before securing debts against your home. A mortgage is a loan secured on your home, which you could lose if you do not keep up your mortgage payments. Check that any mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice.